Management Policy

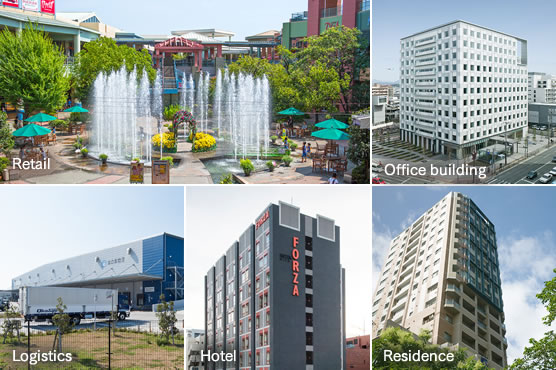

Fukuoka Realty focuses on retail properties that are rich in design and entertainment offerings and have strong competitiveness, as represented by Canal City Hakata, and office buildings, logistics facilities, residences, hotels and others. Our properties are expected to generate stable rental revenues due to their strengths as superior facilities and excellent management capabilities, notwithstanding the trends of land prices in surrounding areas. In addition, Fukuoka Jisho Co., Ltd., the main sponsor, has expertise in developing and operating retail properties, and has a reputation for fast, comprehensive information gathering, leasing and management ability. Our initial focus has been on properties provided by sponsors, properties available in the market, including new development projects by local developers, in order to enhance its portfolio.

Given the support from companies representing Kyushu, Fukuoka Realty will work to manage a variety of properties to achieve excellent performance, serving as a strong partner in creating new cities and communities.